Low-Cost Index Funds

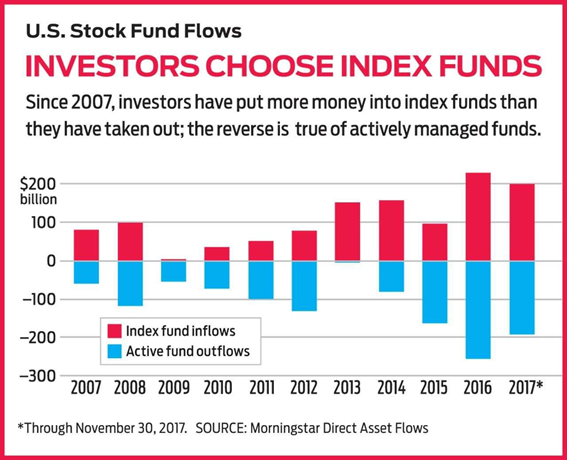

The investment management industry is slowly changing for the better. Low-cost automated index funds are probably the wisest investment option for an individual who doesn’t want to worry about anything, providing better returns than countless high management fee hedge funds. Studies say that low- cost index funds will predominate overactive asset management in the United States by 2021. Why would someone pay for high fees when there are available low-cost index funds that aim to track the performance of the broader market and yet provide better returns than 90% of investment funds that have management fees?

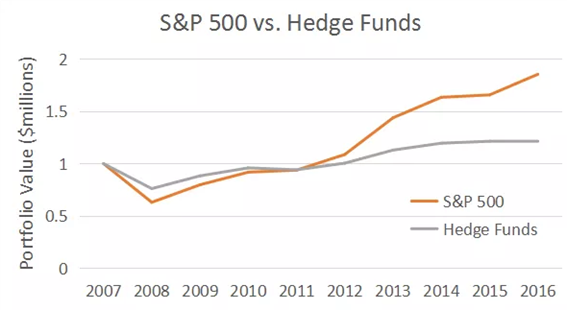

Warren Buffet previously shares his view on the advantages of low-cost automated index funds, madding a bet in 2008 that an unmanaged fund would in ten years outperform a hedge fund portfolio. “The trick is not to pick the right company,” “The trick is to buy all the big companies through the S&P 500 essentially and to do it consistently.” Several studies concluded that, over time, active management would not outperform the actual market. Investing $10,000 in an index fund back in 1942, it would be worth $51 million today. Index funds also have a tax advantage where trading does not happen as often as in active funds, where fees would minimize your returns.

Low-cost index funds are advantageous for investors in the long-term. Investors should be financial advisor’s attentive. John Bogle introduced and helped to shape this revolutionary idea, maintaining some of the lowest fees in the business. This innovative viewpoint allowed investors to beat actively manage funds without basically any effort. For a person that does not wish to care about his/her portfolio, it is fundamental to recognize that low- cost index funds are the best option.